The French state-run utility EDF (Electricité de France) is adapting to a market where wind and solar costs have fallen dramatically and are now often half the cost per megawatt hour of large-scale new nuclear plants.

EDF is planning to invest €8 billion by 2035 to become a European market leader in electricity storage with the aim to develop 10 gigawatts (GW) of additional storage globally by 2035, on top of the 5GW it already maintains.

“With storage we can smooth out the intermittence of renewable energy and guarantee the performance and balance of the grids,” EDF CEO Jean-Bernard Levy saId.

The electricity storage plan is EDF’s latest attempt to position itself at the front of France’s shift into renewables, reducing its heavy focus on nuclear power.

Nick Butler writes in the Financial Times: “The prospect of commercially viable techniques of grid-level storage opens the way for an even bigger shift. If the challenges of intermittency can be overcome and the need for subsidies removed or much reduced, wind and solar can become the natural economic choice for energy supply.”

Under the reforming President Emmanuel Macron and energy minister Nicolas Hulot, the key role of nuclear to France’s post-war energy balance and industrial identity is being questioned.

And private shareholders have seen EDF’s share price fall by 64 per cent since its initial public offering in 2005.

EDF Energy Renewables is reportedly vying with Royal Dutch Shell to win the Mainstream Renewable Power’s auction of a massive offshore wind project called Neart na Gaoithe off the coast of Scotland. The project, worth more than €500 million, involves a 15-year contract to supply energy to the UK grid.

A court ruling in November 2017 paved the way for construction of the project to proceed, after two years of delays.

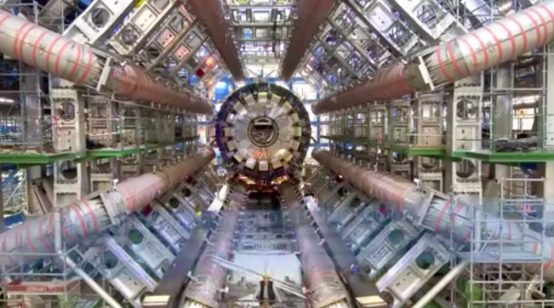

The repeated failures in the design and construction of the new European Pressurised Reactor (EPR) and the latest delay in the construction the first EPR, at Flamanville (pictured) in northern France, is weakening enthusiasm for nuclear in Paris.

EDF faces being divided in two, with the nuclear assets held by the government and a new division, EDF Energies Nouvelle, being set up under new management.

Butler argued: “The transformation of EDF leaves an open question about new nuclear. The EPR is an over-complex failure. But there is still scope for nuclear to play a role in the new global energy market if it can be produced safely and competitively. The case for simpler and more flexible reactors is strong. But it is unclear whether anyone in Europe has the appetite to invest in their development.”

Flamanville in 2010. Picture credit: Wikimedia