Several trends in recent years have dramatically improved Europe’s energy outlook. Its initiatives to embrace renewables in the second half of the 2000s, driven by the earlier leadership of Germany’s Energiewende, have reoriented policies across the continent. Meanwhile, massive new supplies of increasingly lower-cost liquefied natural gas from the United States, Australia, Canada, Indonesia, and Qatar have increased its gas-supply security. The prices of renewables, moreover, have declined annually and dramatically in the past seven years. Wind has long been cheaper than coal and gas, but solar has now nearly caught up. These trends are visible in the United States, according to Lazard’s 2017 analysis of energy prices there.

As important as these developments are, limitations in battery technology will constrain Europe’s ability to implement its most ambitious targets for renewables. Renewables’ most problematic aspect is their inherent intermittency, namely that the sun does not always shine and the wind does not always blow, making them unreliable sources of power. But this is where storage comes in, acting as the bridge between wanting more renewables and adopting them. Users, domestic or commercial, require base load power from sources that are impervious to weather conditions, namely coal, gas, or nuclear. The ability to store solar and wind power, therefore, would put them on equal footing as base load power sources and lead to their wider and deeper adoption.

Yet battery technology remains too expensive, especially for industrial-scale power generation. Last year, Elon Musk heralded his development of the largest lithium-ion battery in Australia, which is slated to bring 100 megawatt hours (Mwh) of electricity. But 100 Mwh are not 100 MW of base load power, prompting skepticism about the project’s actual value in the context of its ambitious execution.

Despite these limitations in battery technology, the EU is promoting innovation in storage through its Horizon 2020 plan. And perhaps more importantly, developments in storage in individual countries portend that the continent is on the right path, according to a report from European Market Monitor on Energy Storage (EMMES). Driven by local subsidies, a growing market for solar and wind power, and the introduction of more affordable options, battery-powered rooftop solar power systems will only increase the growth rate of renewable power generation, distribution, and storage by 2021. Between 2016 and 2017 alone, Europe’s energy storage grew by 50 percent.

Emerging power centers: Sweden, Italy and the UK

The EMMES’ report is the first to examine continent-wide trends in storage and contains several nuggets for those looking for concrete reasons why storage will grow. In Nordic countries, for one, data centers run by technology companies such as Facebook, are set to expand commercial and industrial energy storage facilities due to friendly government policies. Sweden slashed the tax rates for such centers in 2016 by 97 percent, reducing electricity prices for them by roughly 40 percent. This policy will increase the competitiveness of the country’s technology sector and hasten the application of smart-grid technologies that can help more efficiently store and distribute electricity generated by renewables.

Subsidies have largely driven the greater use of renewables in Western European counties such as Germany and Italy over the past decade and are expected to continue. In 2016, Italy launched a €9-billion subsidy scheme to be rolled out over 20 years to fund biomass, wind, and solar projects. Not only is Italy endowed with viable domestic condition for renewable generation, but it has excellent prospects for importing power from solar-rich North Africa through projects championed by the World Bank. In June, the Tunisia-based TuNur project filed a request to export 4.5 gigawatts, with its first leg to Malta targeted for completion in 2020. Renewables accounted for 17 percent of Italian energy consumption in 2017.

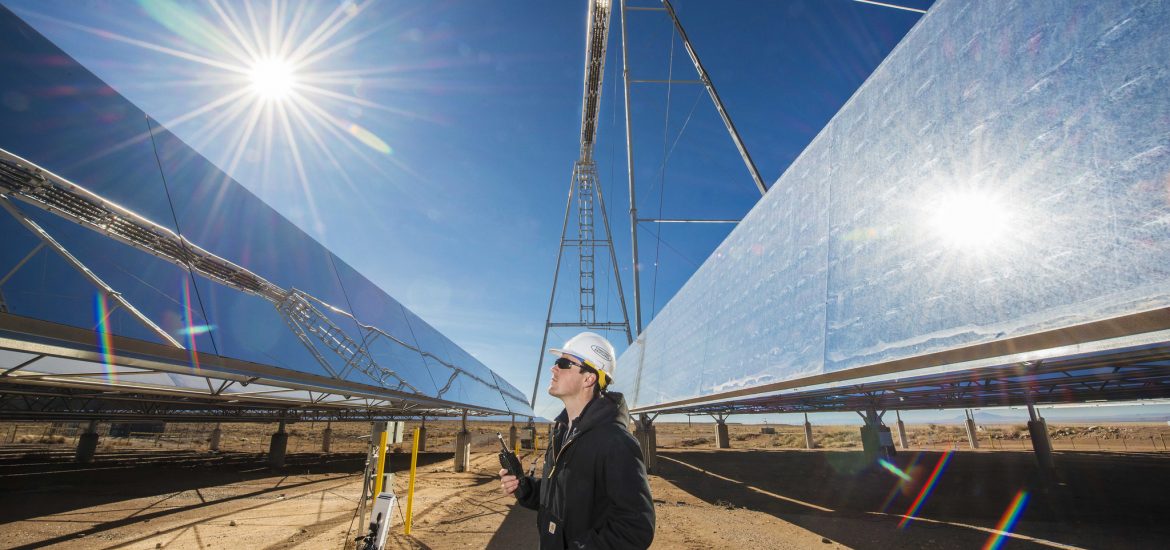

The United Kingdom is taking a different approach by cutting subsidies, but it has experienced growth in so-called behind-the-meter storage, which allows homes and businesses to generate, store, consume and one day even sell solar power from their roofs. This model has seen steady growth in the sunnier parts of the United States and especially by data centers like Tesla’s in Nevada. Ikea began selling affordable battery units for its rooftop solar systems earlier this year, estimating that customers will begin realizing savings from the investment within 12 years.

Green energy is not inevitable

People across the globe have demonstrated in public opinions polls that they are eager to adopt cleaner energies. They recognize that carbon dioxide from fossil fuels and coal most notably dirties their air and triggers a range of health problems in humans, not to mention the despoiling of their natural environments. Politicians have only taken tepid steps, however, to embrace renewables wholeheartedly, largely out of concern for the economic costs of the transition and immediate demands for cheap energy, particularly in countries such as India, where an estimated 240 million people still lack access to electricity. The 2015 United Nations Climate Change Conference held in Paris signaled a new global willingness to fight climate change and increase renewables, but these commitments are not binding.

Despite the technological challenges of making large-scale batteries economic and increasing capacity, Europe should be lauded for taking aggressive steps to incorporate existing technologies to revamp and reorient its energy consumption. The continent must continue along this trajectory, taking advantage of favorable global trends, if it is to push to its final energy frontier.